Pro-privacy browser Brave, which has been testing its own brand search engine for several months — operating a waitlist where brave early adopters could kick the tyres of an upstart alternative in Internet search — has now launched the tool, Brave Search, in global beta.

Users interested in checking out Brave’s nontracking search engine, which is built on top of an independent index and touted as a privacy-safe alternative to surveillance tech products like Google search, will find it via Brave’s desktop and mobile browsers. It can also be reached from other browsers via search.brave.com — so doesn’t require switching to Brave’s browser to use.

Brave Search is being offered as one of multiple search options that users of the company’s eponymous browser can pick from (including Google’s search engine). But Brave says it will make it the default search in its browser later this year.

The company recently passed 32M monthly active users (up from 25M back in March) for its wider suite of products — which, as well as its flagship pro-privacy browser, includes a news reader (Brave News), and a Firewall+VPN service.

Brave also offers privacy-preserving Brave Ads for businesses wanting to reach its community of privacy-preferring users.

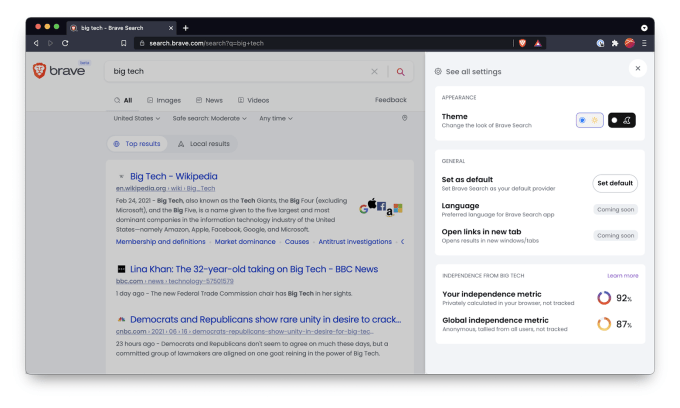

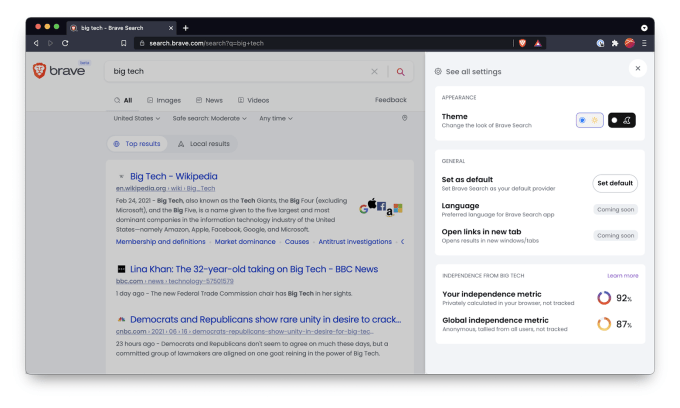

“[Transparency] is a key principle at Brave, and there will also be a global independence metric for Brave Search across all searches, which we will make publicly available to show how we are progressing towards complete independence,” it adds.

Example of Brave’s ‘independence metric’ for search results (Image credits: Brave)

On the monetization side, Brave says it will “soon” be offering both a paid ad-free version of search in the future and an ad-supported free version — while still pledging “fully anonymous” search. Though it specifies that it won’t be flipping the ad switch during the early beta phase.

“We will offer options for both ad-free paid search and ad-supported free search later,” it notes. “When we are ready, we will explore bringing private ads with BAT revenue share to search, as we’ve done for Brave user ads.”

Users of the search engine who do not also use Brave’s own browser will be served contextual ads.

“In Brave Search via the browser, strong privacy guarantees for opt-in ads are a norm and a brand value that we uphold,” adds Pujol, confirming that users of its search and browser are likely to get the same type of ad targeting.

Asked about pricing of the forthcoming ad-free version of the search engine he says: “Although we have not finalized the launch date or the price yet, our ad-free paid search will be affordable because we believe search, and access to information, should be available on fair terms for everyone.”

Source Credits: Tech Crunch

Business1 week ago

Business1 week ago

Business1 week ago

Business1 week ago

Business1 week ago

Business1 week ago

Business1 week ago

Business1 week ago

Business1 week ago

Business1 week ago

Business1 week ago

Business1 week ago

Business1 week ago

Business1 week ago

Business1 day ago

Business1 day ago